Phase 1 – Preparation & Planning PRIOR TO Sale

Time to complete: 2 months to 10 years (2-3 years is optimal – the sooner you get started the better, give us a call if you want to kick off the process!)

Most investment banks and business brokers are transactional, in that they focus solely on executing the sale of your business.

Similar to a real estate agent, they don’t get involved until you decide you actually want to list your business and go to market (Phase 2).

Once your business is sold, you’ll likely never hear from them again.

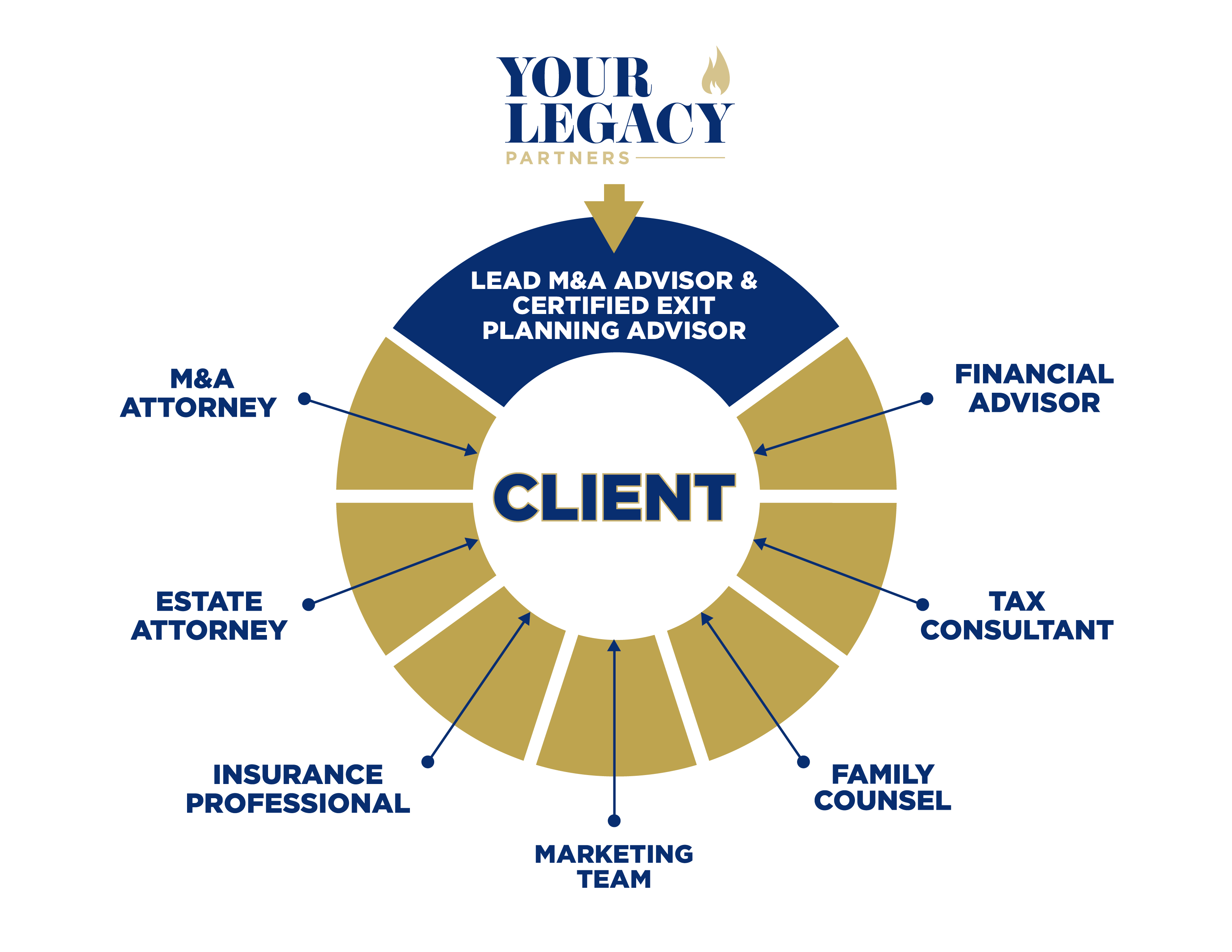

From our decades of experience advising business owners in multiple areas, the business model of Your Legacy Partners is designed to be a true partner to business owners before, during, and after the sale. Owners tell us they value having someone they can count on throughout the entire process and who is vested in their long-term success.

The reason so many other owners leave significant money on the table when selling their business is because they don’t sufficiently plan their exit, integrate it into their overall business strategy and align it with their financial & personal plans. We call this “Aligning the 3 Legs of the Stool”:

- Business: Maximizes Transferrable Business Value

- Financial: Ensures Owner is Financially Prepared

- Personal: Ensures there is a plan for “What Next?”

Being a Certified Exit Planning Advisor (“CEPA”), with broad knowledge across all areas of designing and executing a successful exit plan, we’re able to build strong relationships with our clients and deliver valuable guidance in all areas, over multiple years.

STEP 1: UNDERSTAND

Our first step is to help you get familiar with the process and timeline so you can see the full picture and know what to expect. Everyone’s time frame and priorities are different, so we use our years of experience to help you create a customized timeline, based on your goals, which may evolve over time.

Before we can start building & executing a truly comprehensive plan, we need to understand what’s most important to you. Many owners start by stating they want to maximize price, but what other factors are important to you that may impact the ultimate details of your plan? For instance, what if a buyer wants to change the name of the company, fire a number of employees, or discontinue certain products or services? Are you willing to accept a slightly lower amount from a buyer with those desires? If so, how much less?

A recent study found that over 75% of owners regretted selling their business 1 year later… but not for the reasons you might think. The vast majority of this regret came from the mental and emotional side of not being involved with, and having the identity from, the business that has been such a large part of their lives for much of their life. This is why, we also start to discuss your “personal plan” for after you fully exit during this step.

STEP 2: DISCOVER

Once you understand the process and have begun to deeply consider what’s most important to you, we start to assess where you’re currently at. We take you through a number of assessments that cover all 3 Legs of the Stool: Business, Financial, and Personal that help us get a clear understanding of where we will prioritize our action plan.

In the Business assessments, we start with an in-depth Business Valuation. As a Certified Valuation Analyst (“CVA”) having completed over 200 business valuations, our analysis uncovers the unique aspects of your business to highlight where buyers will see value and where there are the largest opportunities for improvement.

The business evaluation also includes assessing the Attractiveness & Readiness of your business and financial discovery which focuses on your personal assets and strategies as they are today and what you will need in order to accomplish all of your goals.

As a Certified Financial Planner (CFP®) that only works with business owners, our guidance and network of specialists are specifically focused on the unique needs of those with businesses between $5M – $75M of revenue.

STEP 3: PREPARE

Step 3 is where the understanding and discovery from the first two steps begin to be integrated into your truly comprehensive plan. The focus of this step is to design prioritized action plans focused on enhancing business value, coordinating personal financial strategies, and laying initial building blocks for your personal plan in your next act.

These action plans are designed to be implemented over 90-day intervals and are prioritized by order of importance and time needed to complete. Every 90 days we hold a strategy sessions with you to assess progress, answer questions, and prioritize the next 90-day focus.

Throughout this step, we integrate multiple experts from our carefully designed network to contribute their expertise as we design your specific comprehensive plan.

STEP 4: TAX REDUCTION STRATEGIES

As you probably know, owners can lose 25% – 50% of the proceeds from selling their business to taxes. What most owners don’t realize is that there are a number of strategies you can put in place BEFORE you exit that can have a massive impact on the amount of taxes you will ultimately have to pay. Since many of these strategies can often take time to set up and implement, it’s an area that often gets left unimplemented by many owners and can cost them millions of dollars.

We devote a specific step in our process to include multiple meetings with the appropriate expert for your situation so that you can be sure to maximize the amount of sale proceeds that go into your pocket, instead of to Uncle Sam.